Are you a business traveler or a travel hacker looking to get the most out of your loyalty points and frequent flyer miles? In today’s complex travel landscape, simply earning points isn’t enough. You need smart strategies and the right tools to truly maximize their value. This guide will help you navigate the world of travel rewards and transform your points into unforgettable experiences.

We’ll explore how to effectively manage and redeem your hard-earned miles. Furthermore, we’ll highlight the applications that can help you track, strategize, and optimize your rewards. Consequently, you can unlock the full potential of your travel loyalty programs.

The Power of Points and Miles

Loyalty programs and frequent flyer miles are a fantastic way to reduce travel costs. However, many travelers leave significant value on the table. This often happens because they don’t understand the best ways to earn or redeem their rewards. Therefore, a strategic approach is crucial.

For instance, a single credit card sign-up bonus can sometimes be enough for a free flight. The real challenge, however, lies in knowing how to best use those miles. Consequently, you can turn those points into dream vacations or essential business trips.

Choosing the Right Loyalty Programs

Firstly, it’s essential to align your loyalty program choices with your travel habits. You should select an airline that frequently serves your home airport. After all, valuable points are useless if they’re too difficult to redeem. Therefore, ensure the airline or its partners have convenient routes for you.

Moreover, consider the power of airline partnerships. Many airlines are part of larger alliances like Star Alliance, Oneworld, or SkyTeam. This means you can often use your miles on partner airlines. For example, collecting Air Canada Aeroplan points can be beneficial even if you rarely fly Air Canada. This is because Aeroplan is part of Star Alliance, which includes airlines like United Airlines and Singapore Airlines. Thus, you gain access to a much wider network.

Flexibility is Key for Maximizing Redemptions

To truly maximize your travel rewards, flexibility is paramount. Are your travel dates flexible? Can you drive a bit further to a different airport? Are you open to flying into a nearby city and taking ground transportation to your final destination? If you can answer “yes” to any of these, you significantly increase your chances of finding great deals.

Award flight prices can fluctuate considerably. They depend heavily on seat availability and airline pricing strategies. Therefore, if your dates are flexible, you can let the award calendar guide your vacation planning. Generally, booking 11 to 12 months in advance or within 14 days of your trip can yield the cheapest rates, especially for premium cabin seats on transoceanic flights.

Similarly, being flexible with your origin airport can unlock savings. If you live near multiple airports, compare award prices from each. For instance, if you live in Clearwater, Florida, checking award availability from Tampa Bay (TPA), Sarasota (SRQ), and Orlando (MCO) might reveal better options than relying solely on St. Pete–Clearwater International Airport (PIE).

Likewise, consider alternate arrival airports. Sometimes, flying into a less popular airport and taking a short, inexpensive flight or ground transport to your final destination can be much more cost-effective. Even checking major hubs in neighboring countries can uncover surprisingly cheap fares. For example, flying to Dublin or Frankfurt and then taking a low-cost carrier to London can save you money.

Leveraging Credit Cards for Earning Power

Credit cards are a cornerstone of maximizing points and miles. Many cards offer substantial sign-up bonuses that can jumpstart your rewards balance. Additionally, they provide bonus points on everyday spending categories like groceries, dining, and travel.

For instance, American Airlines AAdvantage members can significantly boost their mileage earnings through co-branded Citi credit cards. These cards often come with tiered rewards structures and benefits that align with frequent American Airlines flyers. It’s crucial to understand the specific benefits and earning rates of each card.

When choosing a card, consider your spending habits. A card that offers 3x points on dining might be perfect for a foodie, while a card with bonus rewards on travel purchases would suit a frequent flyer better. Furthermore, always aim to pay your balance in full each month to avoid interest charges, which can quickly negate any rewards earned.

Some cards also offer valuable perks like airport lounge access, free checked bags, or statement credits for travel expenses. These benefits can add significant value beyond just the points earned. Therefore, carefully evaluate all aspects of a credit card offer before applying.

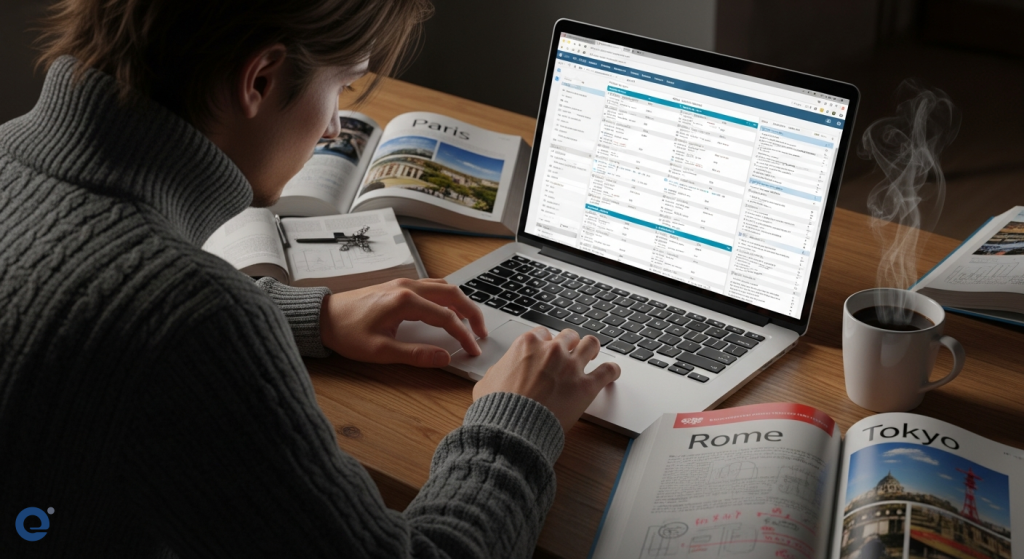

The Role of Dedicated Travel Rewards Apps

Navigating the complexities of multiple loyalty programs, credit cards, and redemption options can be overwhelming. This is where dedicated travel rewards apps become invaluable tools. These applications consolidate your loyalty accounts, track your balances, and even offer insights into the best redemption strategies.

The Points Guy App: A Comprehensive Solution

One prominent example is The Points Guy (TPG) app. This app aims to be a one-stop shop for managing your points and miles. It supports over 70 loyalty programs, including major airlines and hotel chains. You can link your accounts for automated tracking or manually add your points and miles.

The TPG app features a customizable dashboard to monitor your rewards, welcome offers, and spending history. It also includes tools like a “Card Advisor” to help you choose the best card for your spending habits. Furthermore, its “Wallet” feature allows you to see your points net worth across all programs. It even offers a transfer partner calculator to help you maximize the value of your points by transferring them between programs.

The app also provides a curated news feed with the latest travel deals, credit card reviews, and expert advice. This helps you stay informed about opportunities to earn and redeem rewards effectively. Secure bank connections include major issuers like American Express, Bank of America, Barclays, Capital One, Chase, Citi, Discover, and Wells Fargo.

Supported airline loyalty programs include:

- Air Canada Aeroplan

- Air France Flying Blue

- Alaska Mileage Plan

- British Airways Executive Club

- Bilt

- Cathay Pacific Asia Miles

- Delta SkyMiles

- Emirates Skywards

- Etihad Guest

- HawaiianMiles

- Iberia Plus

- Lufthansa Miles & More

- Qantas Frequent Flyer

- Singapore KrisFlyer

- Southwest Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Supported hotel loyalty programs include:

- Best Western Rewards

- Choice Privileges

- Hilton Honors

- IHG Rewards Club

- Marriott Bonvoy

- Radisson Rewards

- World of Hyatt

- Wyndham Rewards

Additionally, it supports other valuable programs like Amazon Rewards, Amtrak Guest Rewards, Diners Club Rewards, and Disney Rewards.

Other Useful Tools

While The Points Guy app is comprehensive, other tools can also be beneficial. For example, point.me is a platform that helps you find award flights across various airlines. It simplifies the search process, which can often be tedious.

Some airlines also offer their own apps with features to track miles and manage your account. Frontier Airlines, for instance, promotes its FrontierMiles program through its website and app. It highlights earning opportunities like 10X miles per dollar spent and redemption options starting at 5,000 miles for award flights. They also offer benefits like FREE bags and seat selection with Elite Status, which can be achieved through spending or status matches.

Maximizing Earnings Beyond Flights

It’s not just about flights. Maximizing your points and miles extends to hotels, car rentals, and even everyday shopping. Many hotel chains have their own loyalty programs, and credit cards often offer bonus points for hotel stays.

For travel hackers, understanding transfer partners is crucial. Some credit card points (like Chase Ultimate Rewards or Amex Membership Rewards) can be transferred to various airline and hotel partners. This flexibility allows you to take advantage of the best redemption rates across different programs.

For example, if you need to fly to a destination not well-served by your primary airline, you might be able to transfer points to a partner airline that does. This requires careful research and understanding of transfer ratios and potential bonuses.

Moreover, shopping portals offered by many credit card issuers and loyalty programs allow you to earn extra miles on your online purchases. Simply click through the portal before making a purchase at a participating retailer. This is a simple way to boost your balance without changing your spending habits.

Redeeming Your Points Strategically

The true test of maximizing rewards is strategic redemption. Don’t just redeem points because you have them. Always aim for the best possible value.

Know the Value of Your Points

Different points have different values. A mile from one program might be worth more than a mile from another, depending on how you redeem it. For instance, redeeming for a business or first-class flight often yields a higher cents-per-point value than redeeming for a short domestic economy flight. Always check the cash price of a ticket before booking with points. This helps you determine if you’re getting a good deal.

Consider the “sweet spots” in different loyalty programs. These are specific routes or redemption options where your points offer exceptional value. For example, some programs offer very low mileage rates for certain international routes or partner redemptions.

Redeem for What Makes You Happy

Ultimately, the best redemption is one that aligns with your travel goals and brings you joy. Whether it’s visiting family for the weekend or planning the trip of a lifetime, use your points in a way that provides the most personal value. Don’t get so caught up in maximizing every last fraction of a cent that you forget to enjoy the travel itself.

Frontier’s Unique Offerings

Frontier Airlines, known for its low fares, also has a loyalty program, FrontierMiles. This program allows members to earn miles on every dollar spent on Frontier flights. They also offer a GoWild! All-You-Can-Fly Pass, which provides unlimited flights for a year for a fixed price, though blackout dates and specific booking windows apply. This pass can be particularly valuable for frequent travelers who can take advantage of it. Additionally, their Discount Den membership offers access to lower fares and can be combined with earning miles.

The Frontier Airlines World Mastercard offers further opportunities to earn miles and achieve Elite Gold Status. This status comes with benefits like free bags and seat selection, which can significantly reduce ancillary costs on ultra-low-cost carriers. This is a prime example of how co-branded credit cards can enhance the value of a specific airline’s loyalty program.

The Citi Connection for American Airlines

For American Airlines loyalists, Citi credit cards are a key component in maximizing AAdvantage miles. These cards often provide accelerated earning rates on American Airlines purchases, bonus miles for hitting spending thresholds, and other travel perks. Researching the specific Citi AAdvantage cards available can help you select the one that best fits your spending profile and loyalty goals.

Frequently Asked Questions

What is the best app for tracking frequent flyer miles?

The “The Points Guy: Travel Rewards App” is a strong contender, supporting over 70 loyalty programs and offering comprehensive tracking and redemption tools. However, the “best” app can depend on your specific needs and the programs you use most frequently.

How can I maximize my credit card points?

Focus on using the right card for the right purchase to earn bonus points. Take advantage of sign-up bonuses, and always aim to pay your balance in full to avoid interest. Also, explore shopping portals and transfer partners for additional value.

Is it better to use points for flights or hotels?

This depends on the redemption value. Generally, high-value redemptions like business or first-class flights can offer better cents-per-point value than hotel stays. However, always compare the cash price versus the points price for both options.

How often should I check for award availability?

Award availability can change rapidly. For popular routes or peak travel times, it’s advisable to check frequently, especially if you have flexible travel dates. Booking well in advance or looking for last-minute deals can also be effective strategies.

Can I combine points from different loyalty programs?

Directly combining points from different airline or hotel programs is usually not possible. However, many credit card rewards programs allow you to transfer points to various partners, effectively allowing you to pool your earning potential by strategically moving points to the program that offers the best redemption for your desired travel.

What are “sweet spots” in loyalty programs?

“Sweet spots” refer to specific redemption opportunities within a loyalty program that offer exceptionally high value for your points or miles. These often involve certain routes, cabin classes, or partner redemptions that are priced attractively compared to their cash cost.

How do airline alliances help me maximize miles?

Airline alliances allow you to earn and redeem miles on a wider network of airlines. For example, if you have miles with United Airlines (part of Star Alliance), you can often use them to book flights on other Star Alliance partners like Lufthansa or Singapore Airlines, expanding your travel options significantly.

Conclusion

Maximizing loyalty points and frequent flyer miles is an art and a science. It requires strategic planning, understanding program nuances, and utilizing the right tools. By choosing the right loyalty programs, leveraging credit card benefits, and employing smart redemption strategies, you can unlock incredible travel opportunities. Dedicated apps like The Points Guy simplify this process, bringing all your rewards information into one place. Remember, flexibility and a keen eye for value are your greatest assets in the world of travel hacking.